Follow us on LinkedIn

After an increase in volatility, equity markets seem to be going back into the state of calmness. Additionally, with Easter coming up, volume and volatility are expected to remain low, at least for a couple of weeks.

However, beside the equity world, the credit market is experiencing a tightening as well. The graph below shows the BofA Merrill Lynch US High Yield Option-Adjusted Spread [1] which is in its lower range since 1998.

Dave Sekera pointed out reasons for the compression of the credit spreads

Much of the tightening has occurred in sectors that are either highly correlated to improving economic conditions or to higher interest rates. For example, in the first quarter, the basic industries sector has tightened the most, as underlying commodity prices have risen off of the early 2016 lows and have held steady thus far this year. Manufacturing has also been one of the better-performing sectors this year. The rise in oil prices has improved the outlook for companies that manufacture equipment used in the oil sector, and the expectation of protectionist policies from the Trump administration has lifted companies that have significant U.S. manufacturing operations. The expectation of rising interest rates has led to outperformance by the finance sector because banks are expected to be able to raise their net interest income margin . Read more

Given the low equity volatility and the tightening of credit spreads, one might ask:

Is there a relationship between the VIX and credit spreads?

Intuitively, there should be; this is because traders can use long-dated out of the money options as a proxy hedge for credit risks.

Formally, indeed, the relationship between credit default swaps (CDS) and stock options written on the same underlying was proved by the academic community. Carr and al examined the joint movements of CDS and equity volatility and showed that they are highly correlated. The authors then developed a model that prices both CDS and equity options at the same time.

We estimate the joint risk dynamics using data from both markets for eight companies that span five sectors and six major credit rating classes from B to AAA. The estimation highlights the interaction between market risk (return variance) and credit risk (default arrival) in pricing stock options and credit default swaps.

The estimation also highlights the interaction between market and credit risk in pricing stock options and credit default swaps. The default arrival rate affects stock option pricing through its direct effect on the risk-neutral drift of the return process. [2]

Given this relationship, there is no surprise that when the VIX is low the CDS is generally low, as they are right now.

However, it’s important to note that like any relationship in financial markets, this one can break down as well.

Footnotes

[1] BofA Merrill Lynch, BofA Merrill Lynch US High Yield Option-Adjusted Spread© [BAMLH0A0HYM2], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLH0A0HYM2, April 2, 2017.

[2] P. Carr, L. Wu, Stock Options and Credit Default Swaps: A Joint Framework for Valuation and Estimation, Journal of Financial Econometrics, 2009, 1–41

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES FOR DISSEMINATION IN THE UNITED STATES TORONTO — Silver Storm Mining Ltd. (“Silver Storm” or the “Company“) (TSX.V: SVRS | FSE: SVR), is pleased to announce that it is further increasing the size of…

One past auction winner now works for Buffett after spending $5.3 million two lunches.

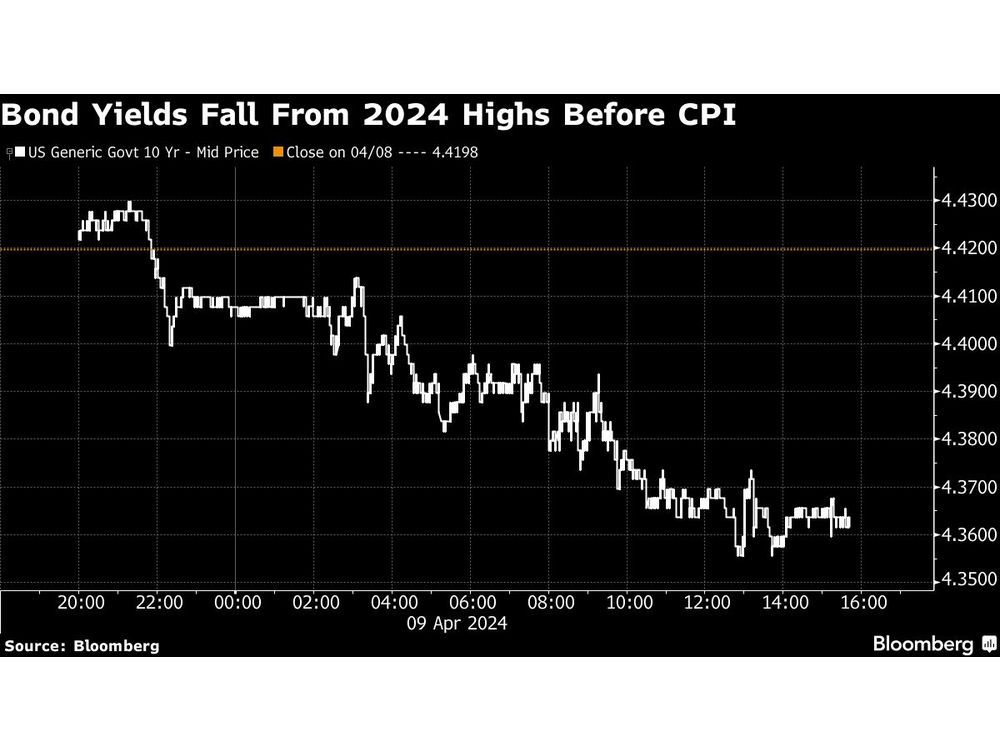

Stocks in Asia mostly pointed higher after US equities recovered and bonds climbed ahead of key inflation data that will help shape the outlook for the Federal Reserve’s next steps.

VANCOUVER, British Columbia, April 09, 2024 (GLOBE NEWSWIRE) — Amcomri Entertainment Inc. (“Amcomri” or the “Company”) (Cboe CA: AMEN) (Frankfurt: 25YO) (OTC: AMNNF) is pleased to announce that the Company has amended and restated its existing credit facilities. The Company amended and restated the agreements…