Follow us on LinkedIn

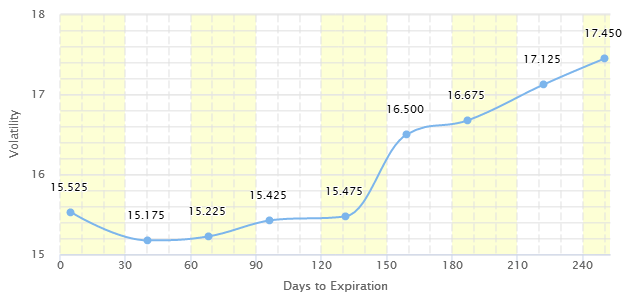

Last Thursday witnessed, again, another dramatic increase in volatility. The volatility index VIX spiked 44 percent to 16.04%, its highest daily close for the year. As shown below, the VIX futures term structure inverted in the short end.

VIX futures term structure as at Aug 10, 2017. Source: vixcentral.com

Two days before the event, Helen Bartholomew of Reuters warned that the net short position in the VIX futures had hit a record high.

Net short positioning in the CBOE’s VIX volatility index futures has hit record highs as investors continue to position for a further decline in the index, despite it trading at historic lows.

The latest Commitments of Traders report from the CFTC, released on Friday, showed that speculators including hedge funds and asset managers held a net short of -158,114 contracts – beating the previous record of -143,845, that was hit in mid-June.

The data comes in spite of Wall Street’s “fear gauge” falling back into single-digit territory in recent sessions, defying an array of economic and geopolitical concerns. Two weeks ago the index touched 8.84 in intra-day trading – a record low – after the US Federal Reserve kept interest rates on hold. Read more

So it came to no surprise that when a correction occurred, VIX futures and options volumes for a single day surged to a new record high, as reported by Tae Kim on CNBC,

The CBOE announced VIX options volume hit 2.56 million contracts on Thursday, a record for a single day. In addition, VIX futures volume reached 939,000 contracts, another record.

The high volume coincided with a 44 percent spike in the VIX, to 16.04, its highest daily close for the year. The VIX recently hit a record intraday low of 8.84. On Friday afternoon, it was at 14.54. Read more

With the increase in volume and open interests, a natural question arises:

Does the cash market lead the futures or the futures leads?

Because the volatility market does not follow the cost of carry relation, the answer to this question is not trivial. In other words, since the cost of maintaining the spot VIX is prohibitive, the none-arbitrage principle does not apply here.

In a recent paper in The Journal of Futures Markets, Bollen et al. provided an answer to this question. They showed that in the early days of the VIX, the cash led the futures. But since 2012, VIX futures leads cash 75% of the time, and by more than 1 minute.

Beginning with VIX futures in 2004, followed by VIX options in 2006 and VIX ETPs in 2009, the daily open interest in volatility contracts is now in the tens of billions of dollars. Given this growth, it is important to develop a better understanding of price discovery and the supply/demand dynamics in each market. Some of the price relations are linked by arbitrage. Others are not. In particular, the relation between the VIX cash index and the VIX futures is not arbitraged, and we show that, where once VIX changes led VIX futures price changes, the VIX futures now leads. Read more

Their finding has important implication for hedgers and speculators who wish to use volatility-linked products to manage the risks.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum