Follow us on LinkedIn

Capital structure is an important determinant factor of a company’s credit risks. In this post, we are going to walk you through an example of calculating the weighted average cost of capital (WACC) using Excel.

The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. The WACC is commonly referred to as the firm’s cost of capital. Importantly, it is dictated by the external market and not by management. The WACC represents the minimum return that a company must earn on an existing asset base to satisfy its creditors, owners, and other providers of capital, or they will invest elsewhere… The WACC is calculated taking into account the relative weights of each component of the capital structure. The more complex the company’s capital structure, the more laborious it is to calculate the WACC…Companies can use WACC to see if the investment projects available to them are worthwhile to undertake. Read more

For illustration purposes, we are going to calculate the WACC of Barrick Gold, a major Canadian mining company.

Barrick Gold as at January 25 2019. Source: Stockchart.com

The WACC is calculated as follows,

WACC =E/(E + D)*Cost of Equity + D/(E + D)*Cost of Debt*(1 – Tax Rate)

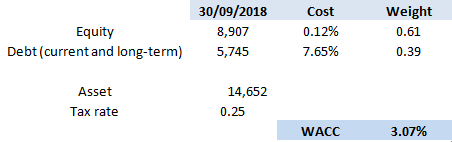

where E and D denote the market values of the firm’s equity and debt respectively. These numbers are taken from Barrick Q3 financial statement.

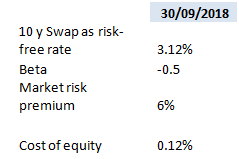

To calculate the cost of equity, we use the Capital Asset Pricing Model (CAPM), according to which the cost of equity is calculated as follows,

Cost of Equity = Risk-Free Rate + Beta * (Market Rate of Return – Risk-Free Rate)

where Beta is the stock’s beta. This post explains how a stock beta is calculated.

Table below shows the calculation for the cost of equity as at September 30, 2018,

As for the cost of debt, we will use the US Materials B- Yield Curve. The 10-year yield is 7.651% as at the Q3 financial reporting date.

Finally, we proceed to calculate the WACC. Table below shows the calculation steps and results,

Click on the buttons below to download the Excel workbook which contains detailed calculation steps and references.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum