Follow us on LinkedIn

The price-to-earnings (P/E) ratio represents the relationship between the market value of the stock of a company and its earnings per share (EPS). It is one of the most commonly used and well-known ratios used by investors in valuing the stocks of a company. Other names for the P/E ratio are the price multiple or earnings multiple.

P/E ratio formula

The formula to calculate the P/E ratio is straightforward and is as follows.

P/E ratio = Market price of stock / Earnings Per Share

The market price of the stock shows its current price in the stock market. Usually, this market price of a stock is readily available from the stock market. The Earnings Per Share (EPS) represent the total earnings of a company divided by its total shares in the last accounting period. The EPS of a company is available in its financial statements, usually in the Income Statement.

Example

A company named Red Co. has a current market stock price of $100. In the previous accounting period, Red Co. had total earnings of $100 million while its outstanding shares in the market were 20 million shares. Therefore, the company’s EPS was $5 per share ($100 million/20 million shares). The P/E ratio of Red Co. is as follows.

P/E ratio = Market price of stock / Earnings Per Share

P/E ratio = $100 / $5

P/E ratio = 20 (times)

Meaning of P/E ratio

When investors use the P/E ratio to evaluate their investments, they must understand what it means. A high P/E ratio signifies that the market trusts the company will grow in the future. Therefore, the market participants are willing to pay higher for the company’s stocks despite the low EPS. However, investing in high P/E ratio stocks also presents higher risks as the growth potential may not capitalize.

Similarly, a low P/E ratio means that the stock of a company is undervalued. These usually represent value stocks in which investors may want to invest. Usually, the reason behind a low P/E is mispricing and can result in outstanding gains once it recovers to its correct value in the market. It may also indicate a company is doing well compared to its past trends.

It is crucial to use the P/E ratio as a comparison tool to make better use of it. P/E ratio cannot give a meaningful result on its own. Therefore, investors must obtain the P/E ratio for different stocks and compare them. Based on their risk preferences, investors can then make decisions in which stock they want to invest. Similarly, it is better to use the P/E ratio to compare between similar stocks, for example, companies within the same industry, for best results.

Limitations of P/E ratio

The P/E ratio has some limitations. First of all, the ratio requires investors to determine the price or EPS of a stock, which may not be possible for every company. For example, for private companies, the information may not be readily available. Similarly, some companies may have volatile market stock prices, which can affect the calculations. The ratio also fails to consider the earning growth of stocks.

Conclusion

P/E, or price-to-earnings ratio, represents the price of a stock in relation to the EPS of the company to which it relates. It is one of the most favourite tools used by investors when making decisions about their investments.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

TORONTO, April 29, 2024 (GLOBE NEWSWIRE) — Golconda Gold Ltd. (“Golconda Gold” or the “Company”) (TSX-V: GG; OTCQB: GGGOF) is pleased to announce the release of its financial results for the year ended December 31, 2023. All amounts are in United States dollars unless otherwise…

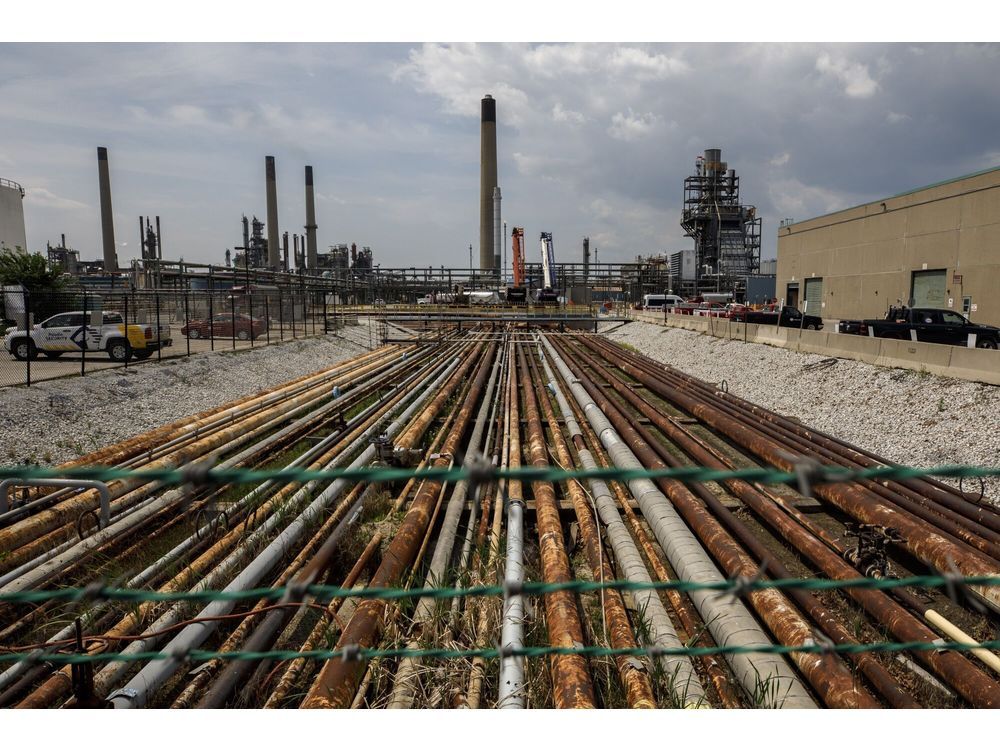

An indigenous community in Alberta’s oil-sands region submitted a proposal to Imperial Oil Ltd. shareholders that would require the company to disclose the financial effect of the energy transition.